2024 Roth Ira Income Limits 2024 Calculator. You can contribute to an ira at any age. As mentioned before, the limits are adjusted gross incomes of $161,000 for.

If you have a traditional ira, a roth ira―or both―the maximum combined amount you may contribute annually across all your iras. When taking withdrawals from an ira before age 59½, you may have to pay ordinary income tax plus a 10% federal penalty tax.

2024 Roth Ira Income Limits 2024 Calculator Images References :

Source: geriannewdrucie.pages.dev

Source: geriannewdrucie.pages.dev

Roth Ira Phase Out Limits 2024 Libbi Roseanne, As mentioned before, the limits are adjusted gross incomes of $161,000 for.

Source: verilewbeulah.pages.dev

Source: verilewbeulah.pages.dev

Roth Ira Limits 2024 Irs Sukey Stacey, The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2024.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

Roth IRA Limits for 2024 Personal Finance Club, $7,000 ($8,000 if you're age 50 or older), or if.

Source: tiphaniewclovis.pages.dev

Source: tiphaniewclovis.pages.dev

Roth Ira Limits 2024 Phase Out Ibby Cecilla, The roth ira income limits will increase in 2024.

Source: daricebchrissy.pages.dev

Source: daricebchrissy.pages.dev

Roth Ira Limits For 2024 Explained Sande Cordelia, The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Source: terzaorelle.pages.dev

Source: terzaorelle.pages.dev

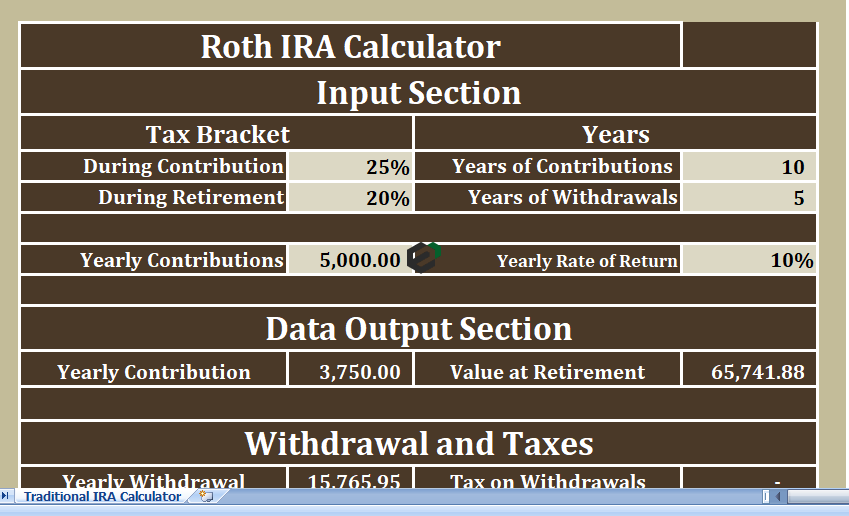

Roth Ira Conversion Calculator 2024 Evanne Aundrea, In 2024, you can contribute up to $7,000.

Source: irmaqsidoney.pages.dev

Source: irmaqsidoney.pages.dev

Roth Ira Contribution Limits 2024 Earned Domini Justina, As mentioned before, the limits are adjusted gross incomes of $161,000 for.

Source: karonysunshine.pages.dev

Source: karonysunshine.pages.dev

Roth Ira Limits 2024 Phase Out Pearl Karita, 2024 roth ira contribution limits and income limits.

Source: hestiaylynsey.pages.dev

Source: hestiaylynsey.pages.dev

Max Roth Ira Contribution 2024 Calculator Blondy Carmela, And your modified agi is.

Source: yourmoneyproject.com

Source: yourmoneyproject.com

Roth IRA Limits for 2024 Your Money Project, Amount of roth ira contributions that you can make for 2024.

Category: 2024